Housing market activity in Canada continued to moderate in July, though underlying demand and sales activity were robust when compared with the historical average. Home builders reported a substantial increase in construction costs, which may contribute to rising house prices in the future.

National Home Sales Moderate Further in July

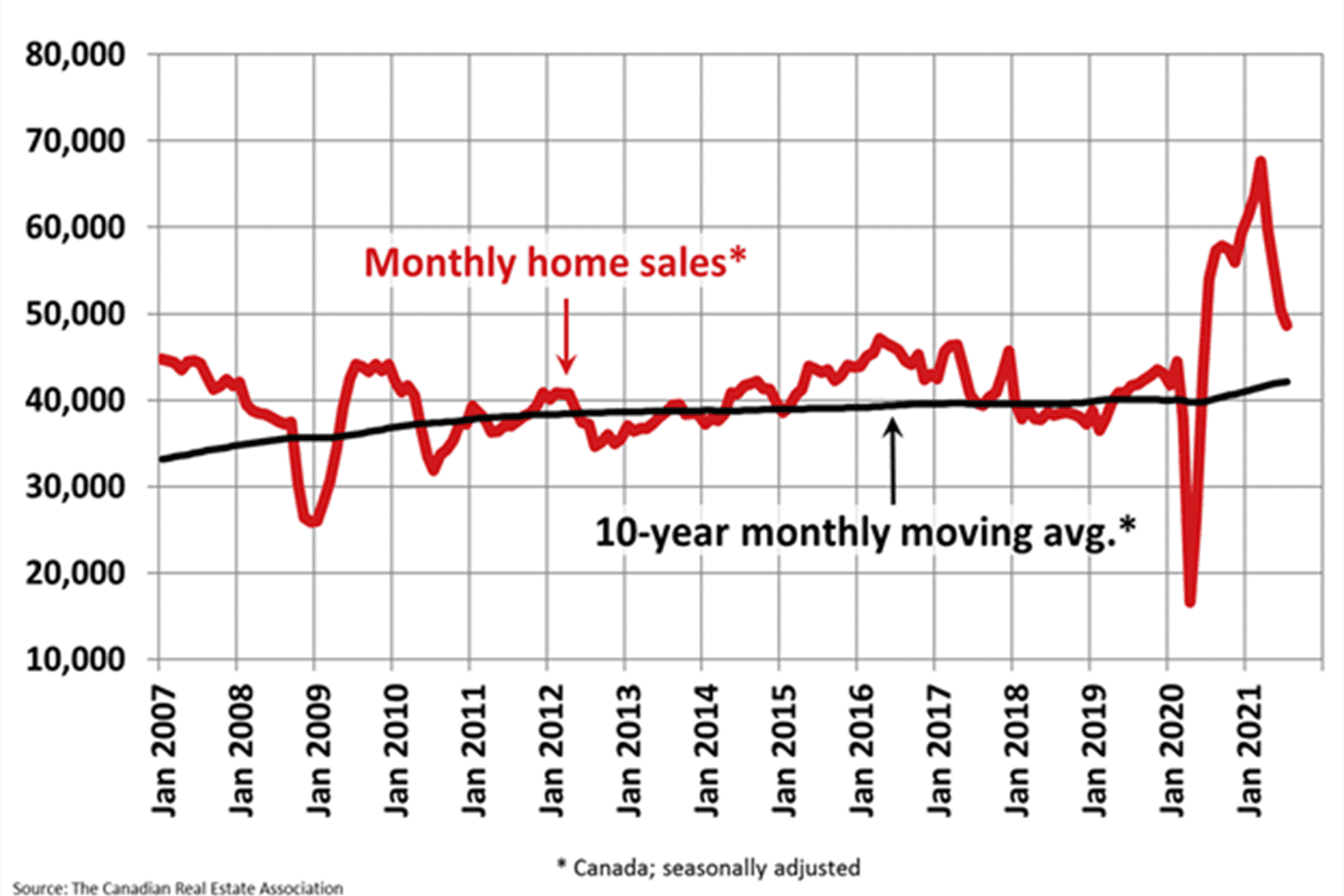

National home sales declined 3.5% in July, marking the fourth consecutive monthly decline, according to the Canadian Real Estate Association (CREA). The July figure represented the smallest decline during the four-month downtrend. Declines were led by Edmonton and Calgary, whereas Montreal experienced a slight uptick in sales.

Home sales are down a cumulative 28% from the March peak, although overall activity remains elevated compared with the long-term average. As CREA reports, home sales are well above the 10-year monthly moving average.

Home sales have moderated substantially from their March peak. However, underlying market conditions remain healthy. | Source: CREA

The MLS Home Price Index rose 0.6% during the month and was up 22.2% year-over-year.

Residential Construction Shows Signs of Cooling

Residential construction investment rose to record highs in the second quarter, as homebuilders continued to accommodate surging housing demand across the country. In the second quarter, residential construction investment reached $43.4 billion, surpassing $40 billion for the first time, according to Statistics Canada. However, in June, investment decreased by 5.8% to $13.8 billion following a 3% decline in May. Despite the declines, residential construction investment remains well above year-ago levels.

Declining home sales in places like Toronto and a surge in material costs may have had a negative impact on housing starts. The Canadian Home Builders’ Association reported that 80% of builders have experienced an increase in lumber costs of $20,000 per home; 30% say they faced increases of over $40,000 per property.

Labour Market Recovery Continues

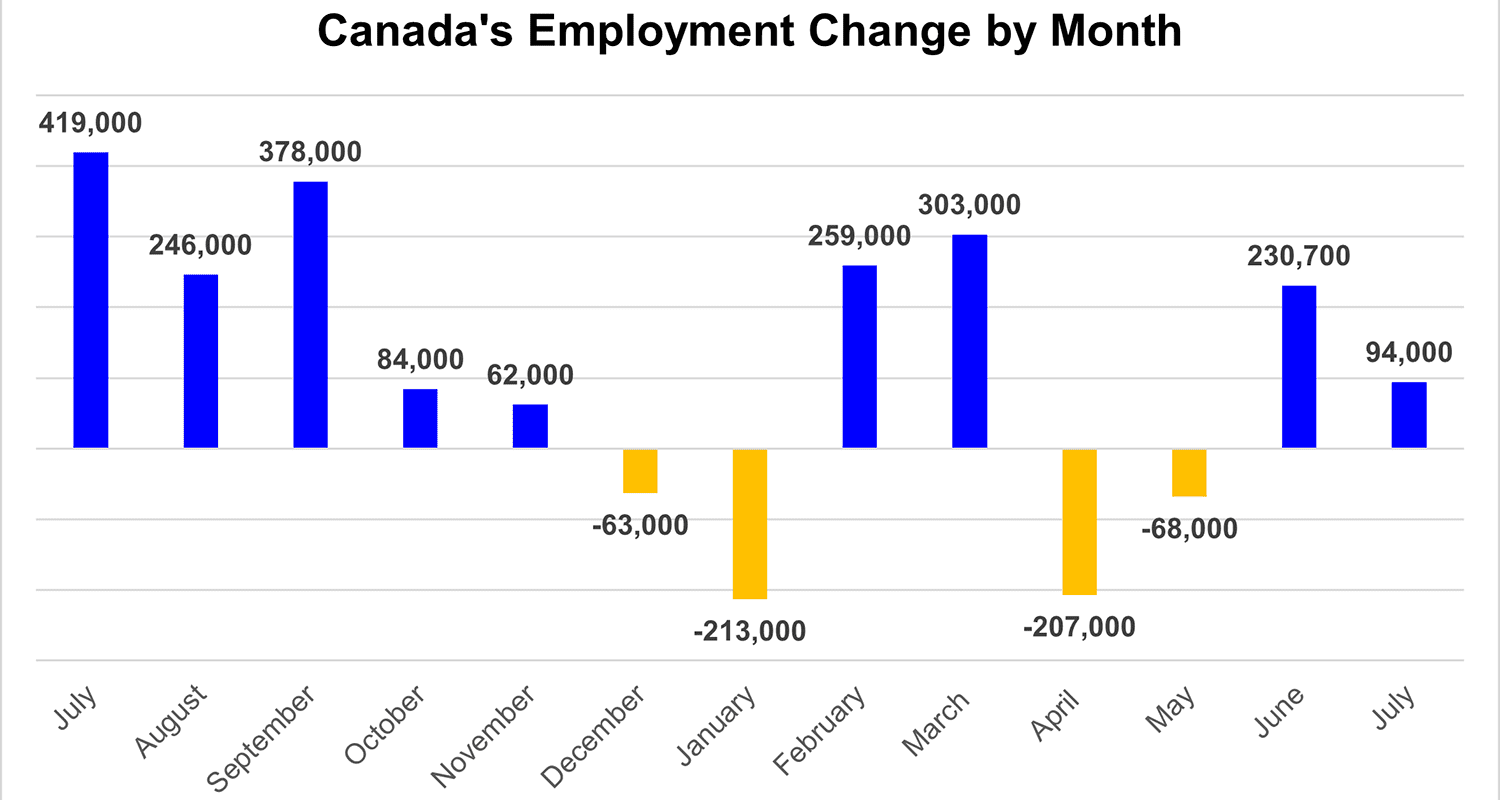

The Canadian labour market improved for a second consecutive month in July, as employers welcomed back 94,000 workers, according to Statistics Canada. The unemployment rate declined 0.3 percentage points to 7.5%. The most positive takeaway from the report was that, unlike in June, July’s employment growth was concentrated in full-time work.

Canada’s employment picture is improving as most provinces gradually loosen their shelter-in-place orders. It remains to be seen whether these trends will be sustained during a fourth wave of COVID-19 infections.

Following back-to-back monthly declines, national employment rose in June and July. | Data source: Statistics Canada

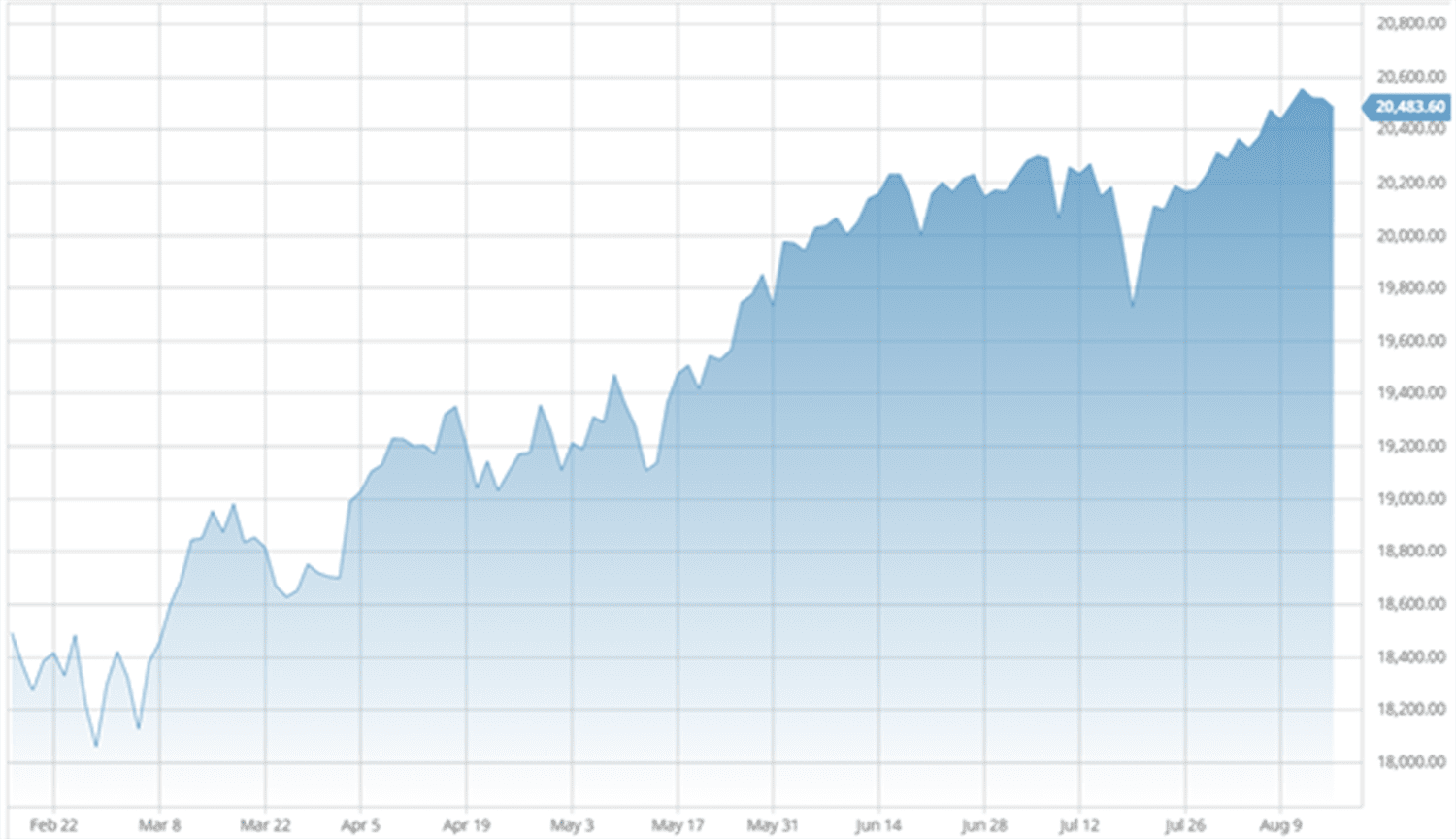

Stocks Hover Near All-Time Highs

Wall Street and Canadian stocks have maintained their upward trajectory into August, as the major indexes continued to flirt with record highs. Despite a moderate pullback, Toronto’s TSX Composite Index remains firmly above 20,000 – a level it first breached in June of this year.

Markets are rallying on positive second-quarter earnings surprises and affirmation from policymakers that the post-pandemic recovery will continue to be supported by lower interest rates.

Risk sentiment remains positive as stocks hover near all-time highs. | Source: barchart.com

Conclusion and Summary

National surveillance of the COVID-19 pandemic indicates that a fourth wave is underway in Canada, according to chief public health officer Dr. Theresa Tam. Most provinces have registered an increase in positive COVID-19 cases, though an upsurge in vaccinations is raising optimism that another lockdown could be avoided. A full reopening of the economy is needed for Canada to sustain its post-pandemic recovery.

What Happens Next?

The CMI Financial Group will continue to analyze market changes and keep you updated on a regular basis. Visit our website to learn more.

Learn more about investing in private mortgages.