Canada’s housing market is showing signs of stabilizing, with home sales edging up slightly in October for the first time in eight months. Although the Bank of Canada (BoC) is poised to continue hiking interest rates to combat inflation, industry data shows buyers are slowly adjusting to the new normal of higher borrowing costs.

Home Sales Rise in October: CREA

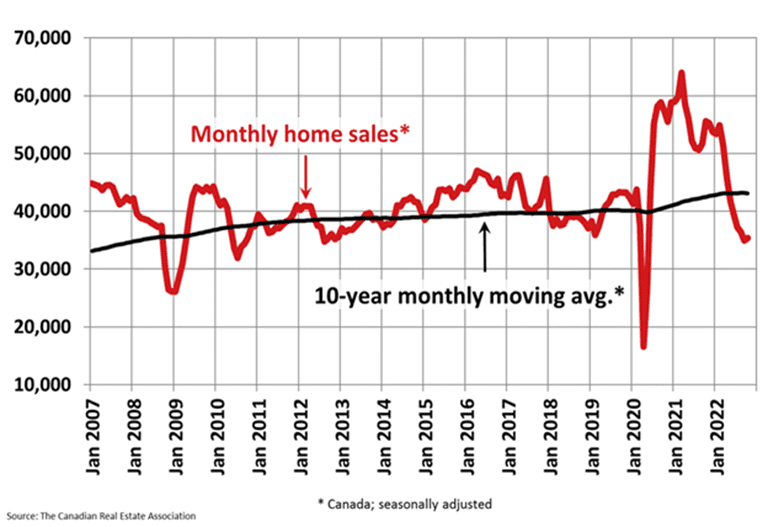

Compared to September, home sales across Canada rose 1.3%, according to the Canadian Real Estate Association (CREA). October marked the first monthly increase since February, which was before the Bank of Canada embarked on its aggressive fight against inflation. Although home sales declined for seven consecutive months through September, CREA acknowledged that the pace of declines has been progressively smaller since May.

The number of newly listed properties increased by 2.2% in October. The MLS Home Price Index was down 1.2% month-over-month but was still up 0.8% compared to October 2021. The actual (not seasonally adjusted) national average home price was just over $644,000. This figure is heavily influenced by sales in Greater Vancouver and the GTA. Excluding sales from these two markets drops the national average price by nearly $125,000.

Canada’s housing market is showing signs of stabilizing after a difficult year. Source: CREA.

Home Prices Likely to Bottom in Spring: RBC Economics

Canada’s housing market could be entering the “latter stages of its cyclical downturn,” a sign that the worst of the price correction is largely over, according to RBC Economics’ Robert Hogue. As such, housing market activity is expected to remain relatively quiet into early 2023 with home prices bottoming around the spring. “The market downturn may be in a late stage but it doesn’t mean things are about to heat up again. We expect high— and still-rising—interest rates will continue to challenge buyers for some time,” Hogue said.

Although market conditions have moderated, Hogue flagged affordability as an ongoing challenge for major markets such as Toronto and Vancouver.

Labour Market Recovers in October

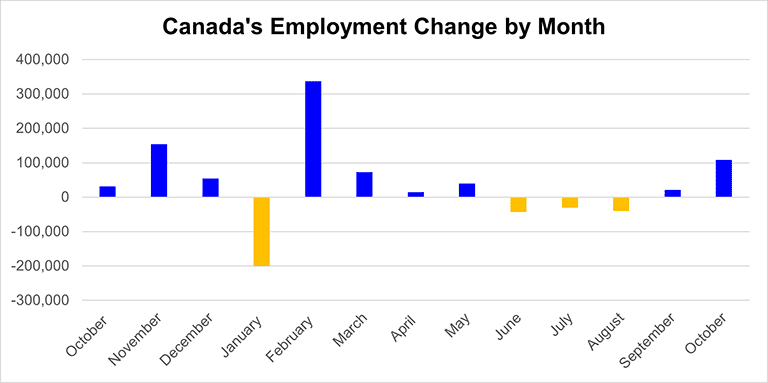

Canada’s labour market rebounded sharply in October, recouping losses from previous months as employers welcomed back full-time workers, particularly in construction, manufacturing, professional services and accommodation and food services. Employment rose by 108,000 compared to September, with full-time jobs accounting for 74,000. The national unemployment rate held steady at 5.2%.

According to TD Economics, the October jobs report signaled that the Canadian economy was off to a good start in the third quarter.

October was the best month of hiring in Canada since February. Data source: Statistics Canada.

TSX Composite Returns to 20,000

After a rocky quarter for equities, Wall Street and Canadian stocks rebounded sharply in the second half of October on speculation that the United States Federal Reserve was prepared to reduce the size of its interest rate hikes. Those expectations were further cemented in November after government data showed consumer inflation rose at a slower pace than expected. On November 13, the Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite all recorded their biggest gain in over two years. The TSX Composite Index, meanwhile, returned above 20,000 for the first time in two months.

The TSX Composite Index is up nearly 10% from its October lows. Source: Barchart.

Conclusion and Summary

In October, the Bank of Canada slowed the pace of monetary tightening due to mounting concerns about recession, opting to increase its benchmark interest rate by 50 basis points as opposed to 75 basis points. Economists believe the central bank will further limit its next rate hike to only 25 basis points when it meets in December for the final time this year. This so-called soft pivot suggests that policymakers are becoming more concerned that the economy is losing momentum more quickly than previously expected.

What Happens Next?

CMI will continue to highlight market trends and keep investors informed. Visit our website to learn more.

Learn more about investing in private mortgages.