Becoming a mortgage investor can be both financially and personally rewarding, but this doesn’t mean that you should purchase the first mortgage investment opportunity that comes your way. Investing in mortgages can yield greater results than if you were to park your funds in a savings account or even the stock market, but it is not without risk. As with any investment, you must set your own parameters and carefully evaluate each opportunity to optimize the chances of a favourable outcome.

With the many factors that come into play, however, you may be asking yourself, Where do I start? Only you can design a detailed set of criteria that perfectly suits your personal goals, but there are determinants that every investor should take into consideration before deciding to take any risks or spend any money.

Due Diligence

In the book The Art of Investing in Distressed Second Mortgages by Sherman Arnowitz, he states, “The due diligence process is the key to determining the value of a particular loan or pool of loans, and ultimately the success or failure of your investment. Performing all of the necessary research in order to find out as much as you can about the loan(s) can be a tedious process, but in the end, it’s time well spent.”

Purchasing a mortgage note or signing off on any deal without doing your due diligence is fraught with considerable risk that should not be overlooked. It is tantamount to giving up any control over the venture and relying on the other parties to act in your best interests. You can hope that your investment won’t go down the drain, but there is a much better way to avoid such a situation.

Doing the proper due diligence will allow you to compare one loan against another, giving you a better sense of which opportunities are actually worth your time and effort. It also raises red flags and warns you of the types of investments (and even people) you generally want to avoid.

The amount of information may be overwhelming, especially at first, but sorting the data will allow you to filter out what you find irrelevant.

In the words of the same author mentioned above, “There’s a fine balance between due diligence and overthinking.” Don’t be intimidated by information overload. Refine your methodology and ranking system, and if something doesn’t feel right, pay attention to what your gut is telling you. It may be trying to point you to critical information that you overlooked.

Mortgage data analysis

A comprehensive mortgage team will handle all aspects of the mortgage financing process from loan origination and property due diligence to funding and servicing the loan. A diligent seamless process allows for the team to not only correctly assess new potential loans but also monitor the existing mortgage portfolio.

Each department works as part of an integrated platform, ensuring a seamless experience where expertise operates in an effective coordinated manner:

- Underwriters. Evaluate, review and underwrite the risk of the loans.

- Investment Directors. Inspect and assign loans to the appropriate investor.

- Fulfilment Staff. Ensure a smooth closing of deals.

- Compliance Staff. Ensure that everything is in proper order.

- Legal Team. Provide reporting packages along with the necessary documentation on closing.

Each recorded mortgage loan will contain pertinent data within a database. The detailed record will paint a reliable picture of the borrower’s payment habits, which can be derived from dates, payment amounts, curtailments, etc.

Some crucial data that is typically monitored include:

- the loan type;

- the original property value;

- the status and balance of any existing liens;

- and the payment history in the last 3, 6, and 12 months.

It is also prudent to check the data against other documents, like a credit report, and add columns containing your notes. You can enter information that matters to you, like bankruptcies, delinquencies, high revolving debt, and civil judgments.

As an individual investor, it would be short-sighted to take a ‘fund it and forget’ investment approach. Instead, loans should be continually monitored to ensure there are no surprises that catch you off guard.

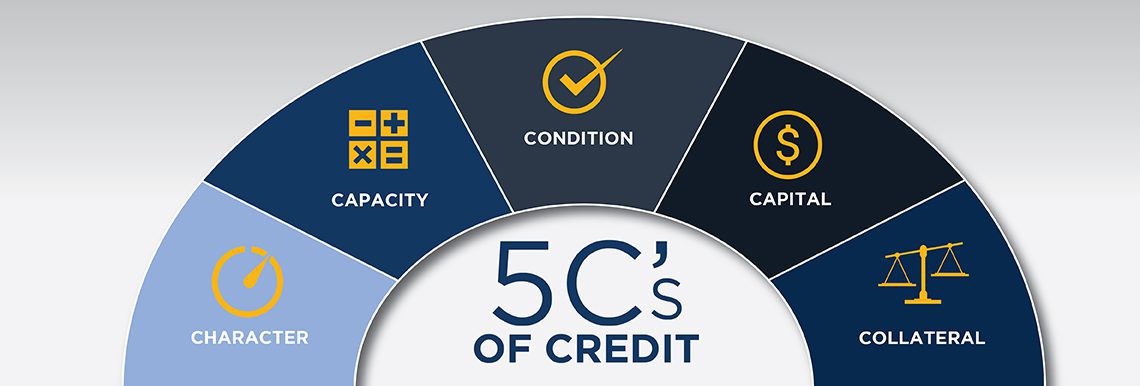

The 5 C’s of Credit

The 5 C’s stand for Character, Capacity, Condition, Capital, and Collateral. These are the general criteria lenders use to evaluate loan applications. They help financial institutions like banks and private lenders assess the risks associated with each loan and determine whether or not the deal works for them.

In much the same way, mortgage investors can benefit from these indicators as well. Like the original lenders, mortgage buyers ultimately need to know whether they’re going to get a return or get their money back at all.

Character

An investor needs to know if the borrower or guarantor can be trusted, and while no one can be expected to read minds, a responsible mortgage buyer should pay attention to documents like credit reports. These will give you an idea of the borrower’s reputation and level of reliability as it contains detailed, objective information like their payment habits and bankruptcies.

Credit reports are also used to determine the rates and terms of a loan, which means they will inform your understanding of the original agreement and why the note is for sale in the first place.

Capacity

To put it simply, capacity refers to the borrower’s ability to pay. This usually means cash flow if the borrower is a company. The business should be able to support the debt, meaning there should be enough money coming in. For individuals, capacity could mean the debt-to-equity ratio, which compares the monthly amortizations to the borrower’s salary. The higher this ratio is, the riskier the loan.

Condition

Context is important when considering any investment. Responsible investing means looking at factors that can affect property values, like the economy, changes or amendments in legislation, and market trends. Aside from these circumstances which are beyond the borrower’s control, you may also want to check why the loan was acquired and if it was indeed used as intended.

Capital

Was a down payment made on the loan? If so, this indicates a borrower’s commitment. It may not have worked out between them and the original lender, but it tells you that there may be more to the story than a borrower’s inability to pay.

Collateral

This is especially important to assess when purchasing a second mortgage. Because the first lien will be prioritized in case of a default, there needs to be enough equity for the second as well.

What this tells you is that a secured loan doesn’t necessarily mean there are zero risks. Proper research will help you avoid expensive mistakes.

The process of evaluation may be overwhelming, but you don’t actually have to do it all yourself. Canadian Lending, Inc., for example, is a private mortgage company that sources funds from individual investors who want to place their money where it can grow. Working with such an entity means that an experienced team will do the brunt of the risk assessment and due diligence.

It’s important to remember that while the real estate market is one of the safest places to put your investments, not all opportunities are created equal. The juice may not be worth the squeeze for a variety of reasons, and each investor will have their own criteria based on their financial and business objectives. When making investment decisions, make sure that you pick a strategy that is aligned with your goals and meets your personal definition of success.