Happy New Year!

As we kick off 2025, we extend our warmest wishes for a successful and prosperous year ahead. We’re excited to embark on another year of partnership and growth, and we’re deeply grateful for your continued trust and collaboration.

As alternative investments continue to capture the attention of investors, private mortgage investments have proven to be a strategic choice for those seeking yield and diversification beyond traditional strategies.

With the private mortgage market poised for further growth in 2025, the demand for accessible, flexible financing solutions is stronger than ever, presenting investors with compelling opportunities. In response to ongoing affordability challenges and stringent lending requirements, private lenders are playing a crucial role in providing essential funding to Canadian borrowers. This is particularly important for the growing segment of gig workers and self-employed individuals, many of whom are high-quality borrowers but are increasingly excluded from traditional lending channels.

At CMI, we take pride in being at the forefront of this shift, offering innovative private mortgage solutions that bridge the gap between opportunity and need, empowering our investors to achieve their financial goals while supporting underserved borrowers.

Our strong performance in 2024 serves as a testament to the impact of this approach.

CMI MIC Funds – 2024 Performance Recap

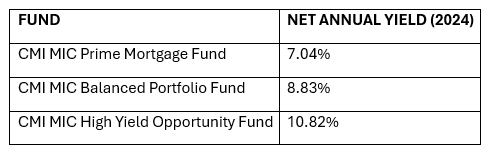

2024 was a banner year for our family of CMI MIC Funds. With a combined total of $97.2 million in new subscriptions, our funds delivered impressive performance across the board, with all three funds achieving annual yields within their respective target ranges. In particular, the Prime Fund raised the high end of its target yield range from 7% to 8%, capitalizing on the elevated interest rate environment:

Assets under management grew across all funds, with notable milestones in both the Prime and High Yield Funds, which saw subscriptions rise by 11% and 40%, respectively, over the year. Both funds have consistently achieved their annual yield targets since inception.

Meanwhile, our flagship Balanced Portfolio Fund saw a substantial 20% increase in subscriptions, further cementing its position as one of Canada’s largest private mortgage portfolios. Since its launch in 2015, the fund has paid a consistent yield of 8-9% annually.

CMI Mortgage Investments – 2024 Highlights

Our whole mortgage investment business continued its rapid growth trajectory in 2024. Our dynamic and responsive business model allowed us to navigate an ever-changing financial landscape, meeting sustained demand while effectively mitigating risk.

New fundings exceeded $653 million last year, bringing our lifetime placements to over $3.1 billion. In parallel, our team of dedicated mortgage investment specialists expanded significantly to meet the growing demand for curated, customized private mortgage investment solutions, and to support our US expansion efforts.

As of year-end, across our portfolio, we manage over $1.035 billion in assets across 3,800 active mortgage investments. Despite ongoing economic headwinds, our historical loan loss rate remains negligible at just 0.14%, reflecting our unwavering commitment to prudent underwriting, robust risk management and rigorous, proactive monitoring.

These results highlight the increasing appeal of private mortgage investments as a compelling alternative asset class for strategic portfolio diversification and enhanced returns, underscoring our ability to deliver high-performing, expertly-managed mortgage solutions.

What to expect from CMI in 2025 and beyond

In the coming year, we’re focused on:

- Pursuing new markets: Increasing our market share in Canada, advancing our US expansion, and exploring emerging opportunities in global markets.

- Innovating our offerings: Delivering high-quality, well-managed mortgage solutions that reflect our commitment to performance and integrity.

- Expanding our partnerships: Broadening our strategic partnerships with advisors and capital market stakeholders to scale distribution channels and diversify funding sources.

- Enhancing our expertise: Continuing to build our award-winning team of industry professionals to ensure unparalleled service excellence and drive innovation.

- Providing timely commentary and market insights: Publishing regular updates through our Weekly Market Monitor and Housing Affordability Watch to keep you informed about economic trends, housing and affordability issues, and market dynamics.

As always, thank you for choosing CMI and entrusting us with your investments. We look forward to another year of growth, innovation, and shared success. For those who are new to CMI, not currently invested, or seeking a trusted private mortgage investment partner, we invite you to contact us if you have any questions or would like to discuss our programs.

Here’s to a prosperous 2025!

Bryan Jaskolka

CEO, CMI Financial Group