For many Canadians, registered retirement savings plans (RRSPs) are the backbone of a retirement savings strategy. While RRSPs have been around for more than half a century, most investors aren’t taking full advantage of their benefits. This often leads to less optimal investment outcomes as we approach retirement age. The first step in maximizing retirement saving success is to fill the knowledge gap about RRSPs.

RRSP Basics

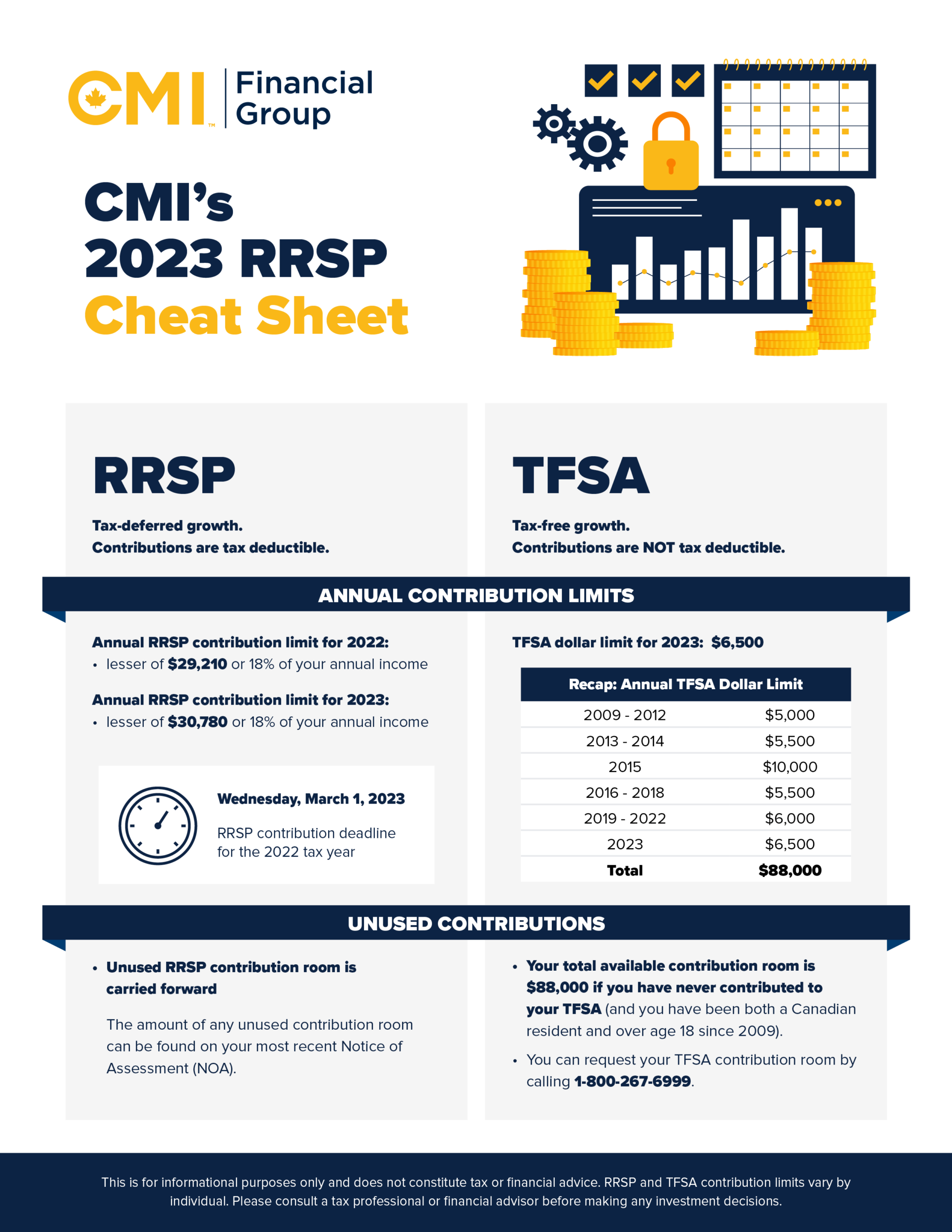

An RRSP is a tax-deferred savings account established by the Canadian government to help you save for retirement. When you register an RRSP, you or your spouse or common-law partner can contribute earned income and unused contribution room from previous years to the fund. The current contribution limit is either 18% of your annual earned income from the previous year or the maximum contribution amount allowed by the government, whichever is less. In 2023, the maximum contribution limit set by the government is $30,780. Unused contribution room can be carried forward indefinitely, which means if you don’t have the money to maximize your RRSP contribution this year, you can carry forward your amounts to future years.

If you exceed your deduction limit by more than $2,000, a 1% tax per month is applied to your excess contributions. However, this does not apply if you withdrew the excess amounts before the end of the month when the excess contributions were made or contributed to a qualifying group plan.

Qualified investments in an RRSP include stocks, bonds, mutual funds, exchange-traded funds, Guaranteed Investment Certificates (GICs), managed investment programs, Mortgage Investment Corporations (MICs) and cash. That means your RRSP investments can benefit from compounding rates of return across various asset classes as you save for retirement.

One of the biggest advantages of RRSP investments is they allow you to save for retirement in a tax-preferred way. RRSP contributions are deducted from your gross income, thereby reducing your taxable amount. Capital gains, interest and dividends earned in an RRSP are not taxed until they are withdrawn from the RRSP. To fully capitalize on the tax benefits for any given year, you must make your RRSP contribution by the end of the year or in the first 60 days of the following year.

RRSPs have been set up to incentivize Canadians to save for retirement. Funds can be withdrawn at any age, but you can expect to pay an immediate withholding tax from the proceeds, and the amount will be included in your income and taxed at your marginal rate. Also, funds cannot be re-contributed once withdrawn – the contribution room is permanently lost.

How much tax you end up paying depends on your province of residence and how much you take out. The current withholding tax rates on RRSP withdrawals are:

- 10% on withdrawals of up to $5,000.

- 20% on withdrawals between $5,001 and $15,000.

- 30% on withdrawals of more than $15,000.

These tax rates apply everywhere in Canada except Quebec. In Quebec, the federal rates are lower, but provincial tax rates apply in addition to the federal withdrawal rate.

Your taxable income for the year will also include the amount of the RRSP withdrawal, which means you may be subject to additional tax payments if your marginal rate is higher than the RRSP withholding rate.

An RRSP matures when you reach 71 years of age, at which point you have three options for withdrawing your investments: take a lump sum withdrawal, convert your RRSP to a Registered Retirement Income Fund (RRIF) or purchase an annuity.

As we will see in the following section, you may have a good reason for dipping into your RRSP savings before retirement, but this should be done with careful planning.

Going Beyond the Basics

Even a basic handle of RRSPs can have major implications on your retirement planning success. But to fully maximize your retirement savings strategy, it’s important to go beyond the basics.

Time your tax deduction. For starters, we need to differentiate between tax deferral of underlying investments and tax deductions on your income when you make a contribution. Most people claim their entire RRSP deductions in the same year they make their contribution. However, you may choose to claim only a portion of your RRSP deduction, or none at all, and carry it forward to future years. You may find it more prudent to defer your RRSP tax deduction to the future if you anticipate you will have higher taxable income in an upcoming year.

Consider eligibility for other benefits. RRSP contributions can also help you qualify for other income-based benefits. That’s because RRSP contributions reduce your net income, which could lead to increased eligibility for refundable tax credits like the Canada Child Benefit or the GST/HST credit.

Benefit from spousal contributions. One of the most overlooked aspects of retirement planning through RRSPs is spousal contributions. Although an RRSP matures on December 31 of the year you turn 71, you can still contribute to your spouse’s or common-law partner’s RRSP until the end of the year they turn 71. The contribution amounts could be significant for individuals who continue to accrue earned income after age 71 or have carried over contribution room from previous years.

Fund other financial goals. In the RRSP Basics section, we explained that haphazard withdrawals from your RRSP before retirement can carry significant tax penalties. However, these penalties can be avoided if you withdraw the money to fund your first home purchase, pursue education or help family members with disabilities. Under the Home Buyers’ Plan, you can withdraw up to $35,000 from your RRSP to purchase or build a qualifying home for yourself or a relative with a disability. Under this program, you have up to 15 years to pay back the withdrawn funds. Similarly, the Lifelong Learning Program allows you to withdraw up to $10,000 in a given year and $20,000 total to fund your education. You have 10 years to repay the amounts withdrawn under the LLP. Generally, you have to repay 1/10 of the total amount withdrawn each year until the LLP balance is zero.

Make strategic withdrawals. Early withdrawals from your RRSP may also make sense if you become unemployed or need to tap into emergency funding. Any scenario that results in low relative net income may necessitate an early RRSP redemption. Early withdrawals could also make sense if you anticipate you’ll be in a high tax bracket in retirement. In this scenario, drawing down on your RRSPs before retirement could reduce your taxable income in retirement and minimize the likelihood of your Old Age Security payments being clawed back due to your higher income bracket.

Maximize Your RRSP Success with Mortgage Investments

With so many qualified investment options for their RRSP, investors must think carefully about how to optimize their portfolios for retirement. Each investment opportunity carries its own set of risks and benefits, and not all assets offer the same rates of return. As the boom-and-bust cycle of public markets has demonstrated, the performance of most asset classes is strongly correlated with the actions of central banks and expectations around monetary policy.

Mortgage Investment Corporations, or MICs, are a class of alternative assets that pool investor capital for the purpose of investing in a portfolio of mortgages. Funds deposited into a MIC are lent out to qualified borrowers, usually to facilitate short-term borrowing needs in the form of first and second mortgages. This real estate-backed investment is managed by a professional team of experts who are responsible for managing the risk and ensuring the geographic diversification of the portfolio.

Investors who deposit money into a MIC receive shares in the underlying fund, which entitles them to dividend payments generated by the fund. The MIC generates income by collecting interest and fees from the mortgage borrowers. In Canada, MIC shares are qualified investments under the Income Tax Act and are therefore eligible for inclusion in RRSPs and Registered Retirement Income Funds (RRIFs).

MICs enjoy the same preferential tax treatment as other investable assets within an RRSP – dividend payments can be earned and reinvested for compound growth without being subject to taxation. Outside of an RRSP, dividend income for a MIC is treated as interest income and taxed at an investor’s marginal tax rate. For this reason, holding a MIC within an RRSP can be a highly effective tax planning strategy.

MIC funds that offer a well-planned Dividend Reinvestment Plan, or DRIP, can help you reach your retirement savings goals faster. A DRIP is a commission-free dollar-cost averaging system that allows investors to purchase additional shares of the MIC rather than receive their dividend payments in cash. This enables them to earn a greater share of the MIC if invested for the long run.

Industry data also shows that MICs routinely outperform traditional fixed-income securities such as government and corporate bonds. Because MICs invest in mortgages backed by real estate, they carry less investment risk than home ownership.

Getting started with mortgage investing in an RRSP is easy. One of the best ways is to work with an experienced investment corporation. CMI Mortgage Investments is one of Canada’s fastest-growing non-bank financial institutions, having originated more than $1.6 billion. Learn more about how CMI MIC Funds can help you reach your retirement savings targets and contact one of our Investment Professionals today for a free consultation.

See CMI’s 2022 RRSP Cheat Sheet for key facts, figures, and deadlines you’ll need to know to maximize your tax savings.