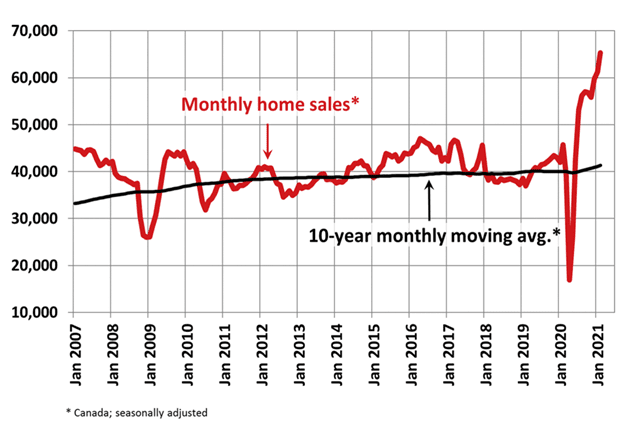

February was another record-setting month for Canada’s real estate market, as home sales continued to rise, offering further evidence of a rebounding economy. Like in previous months, supply shortages were prevalent across many local markets despite a large rebound in the number of newly listed properties.

Canada’s Housing Market: By the Numbers

National home sales increased 6.6% in February to a seasonally adjusted annual pace of 786,636 units, a new all-time high, according to the Canadian Real Estate Association (CREA). Compared with February 2020, home sales rose 39.2%.

CREA indicated that the current sales pace will be difficult to maintain without a surge in new supply. While the number of newly listed properties rebounded 15.7% from January, the sales-to-new listings ratio remains elevated compared with the historical average. In February, sales-to-new listings reached 84%, down from a record high of 91.2% in January.

With homes in short supply and demand rising, real estate prices rose 3.3% during the month and 17.3% annually, CREA said.

“Fear of Missing Out” Drives Homebuyers – RBC

With homes in short supply, buyers are increasingly driven by a sense of urgency, according to Robert Hogue of RBC Economics. He explained:

“Homebuyers were still clearly on the hunt for their dream house—or any house—in Canada’s major markets last month. Competition for the few available units was not only fierce but increasingly driven by a sense of urgency or ‘fear of missing out’.”

The supply shortage has fueled substantial growth in resales in places like Fraser Valley, Vancouver, Calgary and Toronto. According to Hogue, big-city buyers are warming up to condos again due to the supply-demand imbalance.

The silver lining is that, in places like Toronto, higher home prices are attracting more sellers to market. February saw a sharp rise in single-family home sellers, with new listings in this category rising 34% year-over-year.

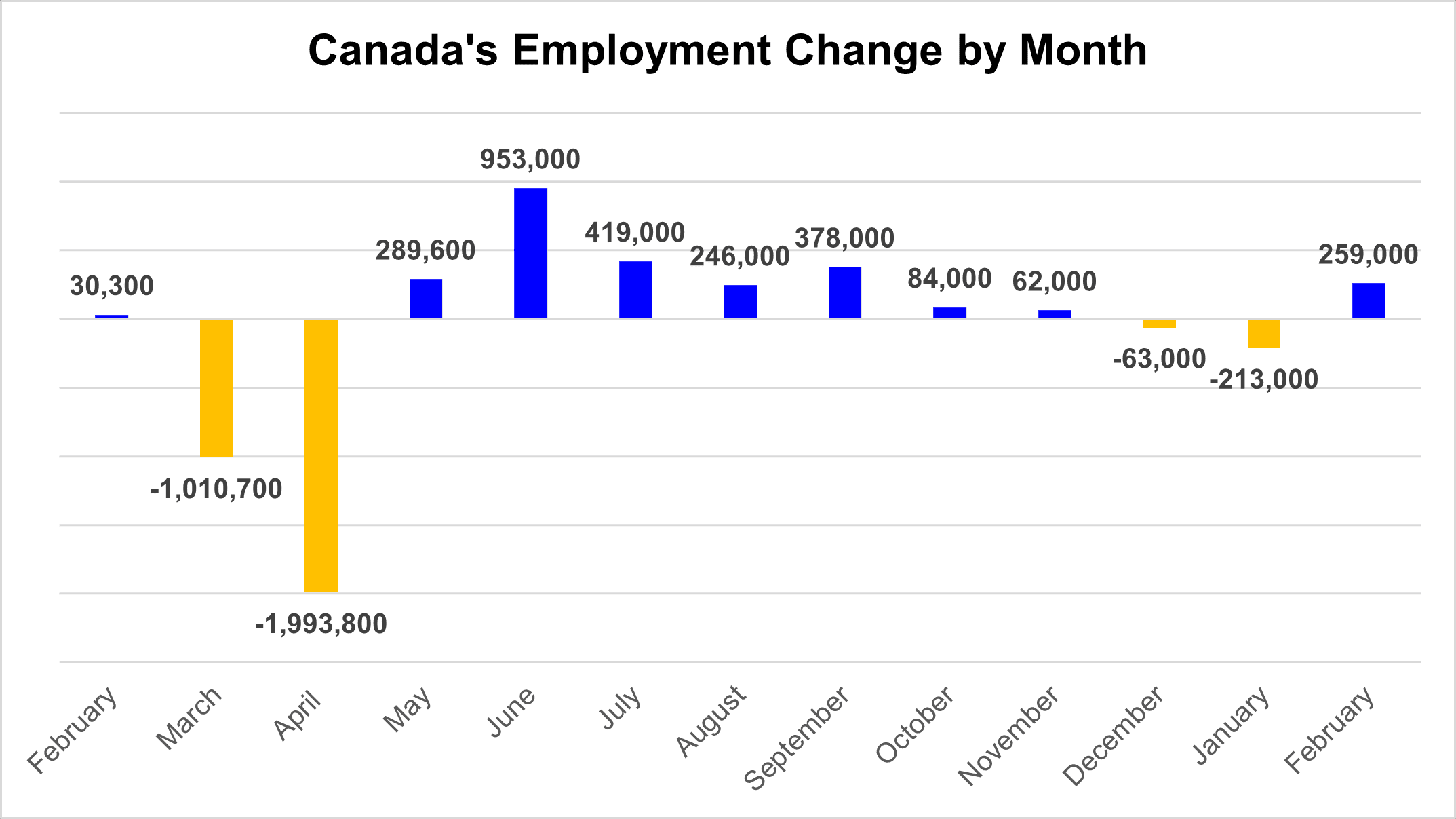

Labour Market Rebounds in February

Canada’s job market experienced a sharp rebound in February, as the gradual easing of COVID-19 restrictions allowed more people to return to work. The economy added 259,000 jobs during the month, including 171,000 part-time jobs and 88,000 full-time positions, according to Statistics Canada. Accommodation and food services—an industry hit hard by the pandemic—added 187,000 positions, official data showed.

The unemployment rate declined 1.2 percentage points to 8.2%, the lowest since March 2020. The number of long-term unemployed declined by 49,000 after hitting a record high of 512,000 in January.

After losing more than 200,000 jobs in January, the Canadian labour market rebounded sharply in February. | Source: Statistics Canada

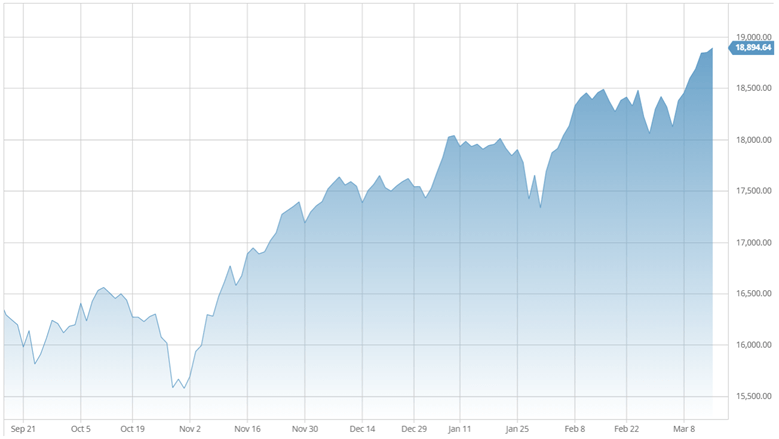

Stocks Return to Record Highs

Wall Street and Canadian stocks experienced turbulence at the beginning of March, as rising bond yields triggered a sharp selloff in the major indexes. The 10-year U.S. Treasury yield, which moves inversely to price, rose to more than one-year highs over concerns that President Biden’s stimulus plan could fuel inflation. Expectations for inflation over the next decade have risen to a seven-year high.

The CBOE Volatility Index, commonly known as the VIX, spiked in late February and early March before declining sharply over the next several weeks. The volatility gauge is back to trading around 20, which is in line with the historical average.

Despite the volatility, Canada’s benchmark S&P/TSX Composite Index returned to record highs in mid-March, largely on the strength of utility and real estate companies. In the United States, the S&P 500 Index and Dow Jones Industrial Average also returned to record territory after President Biden signed a $1.9 trillion fiscal relief package.

After initial turbulence, the TSX Composite Index set new all-time highs in March. | Source: barchart.com

Conclusion and Summary

It has been roughly one year since the Bank of Canada cut interest rates in response to the COVID-19 pandemic. Although the Canadian economy appears to have avoided a worst-case scenario, the road to full recovery depends on the evolution of the pandemic. According to the Business Development Bank of Canada, strong consumption, a rebound in exports and government investments will give the economy a boost. Conversely, the postponement of business investments could limit the extent of the recovery.

What Happens Next?

CMI Financial Group will continue to analyze market changes and keep you updated on a regular basis. To learn more about our investment opportunities fill out the contact form below, and one of our Investment Managers will reach out to you within 24 hours.